5 Ways Marriage Affects Food Stamps

Introduction to Marriage and Food Stamps

Marriage can have a significant impact on an individual’s life, affecting various aspects including finances, living situation, and even government benefits such as food stamps. Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), are designed to help low-income individuals and families purchase food. When two individuals get married, their combined income and resources are considered when determining eligibility for food stamps. In this article, we will explore the ways marriage affects food stamps and what individuals should consider when applying for or receiving these benefits.

Combined Income and Resources

When two individuals get married, their incomes are combined, which can affect their eligibility for food stamps. The total household income is considered when determining eligibility, and if the combined income exceeds the allowed limit, the household may no longer be eligible for benefits. For example, if one spouse has a moderate income and the other has a low income, their combined income may exceed the eligibility threshold. It’s essential for couples to understand how their combined income will affect their food stamp benefits.

Changes in Household Size

Marriage also affects household size, which is another factor considered when determining food stamp eligibility. Household size is defined as the number of people living together and purchasing food together. When two individuals get married, their household size increases, which can impact the amount of benefits they receive. A larger household size may result in a higher benefit amount, but it’s crucial to report any changes in household size to the relevant authorities to ensure accurate benefit calculations.

Asset Limitations

Food stamp eligibility is also affected by asset limitations. When two individuals get married, their combined assets are considered, and if the total value exceeds the allowed limit, they may no longer be eligible for benefits. Assets include items such as cash, savings accounts, and investments. Couples should be aware of the asset limitations and how their combined assets will affect their food stamp eligibility.

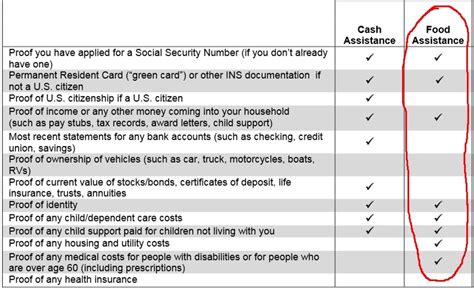

Reporting Requirements

Married couples receiving food stamps must report any changes in their household situation, including income, resources, and household size. Failing to report changes can result in inaccurate benefit calculations, and in some cases, may lead to benefits being terminated. It’s essential for couples to understand their reporting requirements and to notify the relevant authorities of any changes in their household situation.

Strategies for Managing Food Stamp Benefits

To manage food stamp benefits effectively, married couples can consider the following strategies: * Track income and expenses to ensure accurate reporting and benefit calculations * Report changes in household size and income promptly to avoid inaccurate benefit calculations * Understand asset limitations and how combined assets affect eligibility * Seek assistance from a social worker or benefits counselor if needed

| Household Size | Monthly Gross Income Limit | Monthly Net Income Limit |

|---|---|---|

| 1 | $1,926 | $1,383 |

| 2 | $2,607 | $1,877 |

| 3 | $3,288 | $2,371 |

📝 Note: The income limits listed in the table are subject to change, and couples should check with their local authorities for the most up-to-date information.

As we conclude our discussion on the impact of marriage on food stamps, it’s clear that couples should carefully consider how their combined income, resources, and household size will affect their eligibility for these benefits. By understanding the rules and regulations surrounding food stamps and taking steps to manage their benefits effectively, married couples can ensure they receive the support they need to purchase food and maintain a healthy lifestyle.

How does marriage affect food stamp eligibility?

+

Marriage can affect food stamp eligibility by combining the incomes and resources of both spouses, which may exceed the allowed limits and impact eligibility.

What is considered when determining household size for food stamps?

+

Household size is defined as the number of people living together and purchasing food together. When two individuals get married, their household size increases, which can impact the amount of benefits they receive.

How often do I need to report changes in my household situation to the authorities?

+

It’s essential to report changes in your household situation, including income, resources, and household size, promptly to avoid inaccurate benefit calculations. The frequency of reporting may vary depending on your location and the specific requirements of your local authorities.