5 WA Paycheck Tips

Understanding Your WA Paycheck

When it comes to managing your finances, one of the most crucial aspects is understanding your paycheck. For residents of Washington State, or those interested in the specifics of WA paychecks, it’s essential to grasp the ins and outs of how your income is calculated, taxed, and what you can do to maximize your take-home pay. This guide will delve into five key tips to help you navigate the world of WA paychecks effectively.

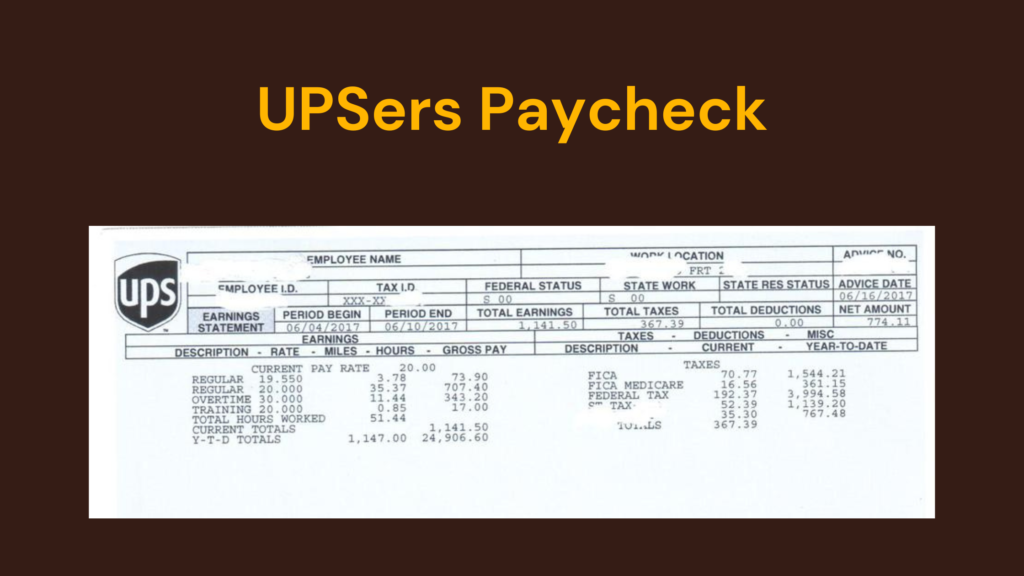

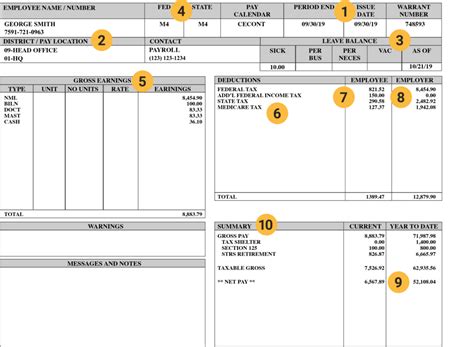

Tip 1: Calculate Your Gross Income

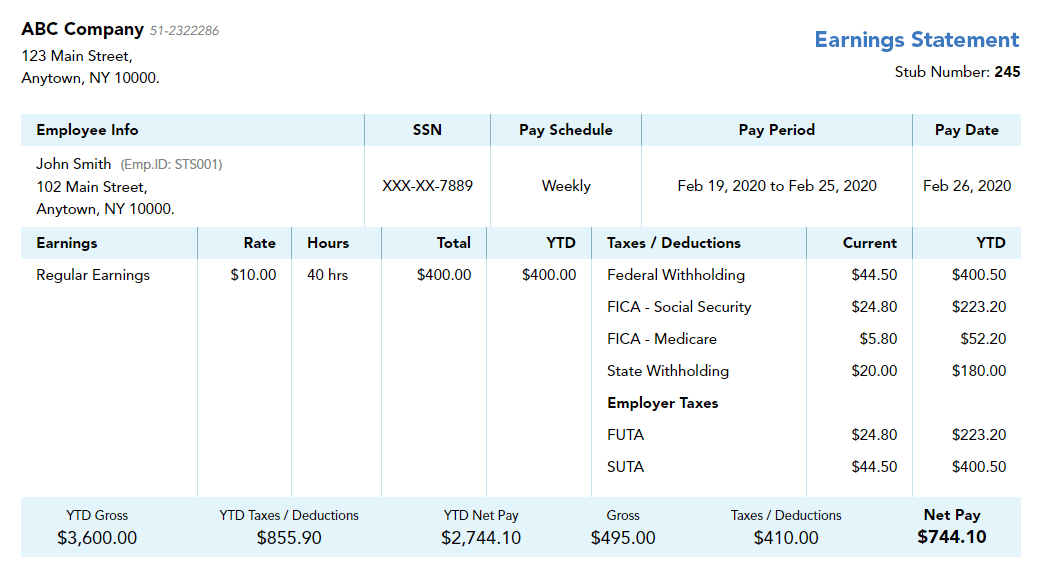

The first step in understanding your WA paycheck is to calculate your gross income. Gross income refers to the total amount of money you earn before any deductions are made. This includes your salary, wages, tips, and any other form of income. To calculate your gross income, you can use the following formula: - Gross Income = Hourly Wage * Hours Worked Per Week * Weeks Worked Per Year For example, if you make 25 per hour, work 40 hours a week, and work 52 weeks a year, your gross income would be 25 * 40 * 52 = $52,000 per year.

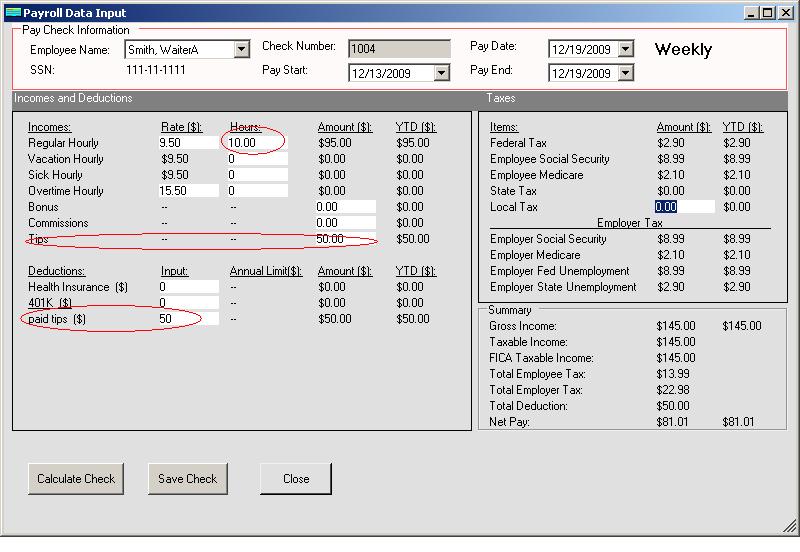

Tip 2: Understand WA State Taxes

Washington State is known for having no state income tax, which can significantly impact your take-home pay. However, it’s crucial to understand that while there is no state income tax, there are other taxes and deductions that will affect your paycheck. These include: - Federal Income Tax: This is the tax levied by the federal government on your income. - Social Security Tax: This tax funds social security benefits and is typically 6.2% of your earnings, matched by your employer. - Medicare Tax: This tax funds Medicare and is 1.45% of your earnings, also matched by your employer. - Other Deductions: These can include health insurance premiums, 401(k) contributions, and other benefits.

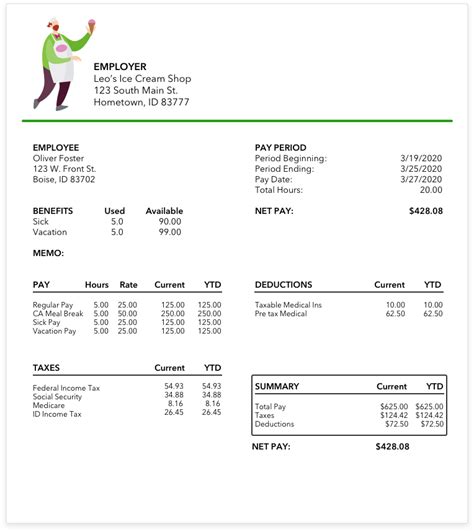

Tip 3: Maximize Your Take-Home Pay

To maximize your take-home pay, consider the following strategies: - Contribute to a 401(k) or Retirement Plan: Contributions to these plans are made before taxes, reducing your taxable income and potentially lowering your federal income tax liability. - Utilize Health Savings Accounts (HSAs): If you have a high-deductible health plan, you can contribute to an HSA, which allows you to set aside pre-tax dollars for medical expenses. - Take Advantage of Tax Credits: Look into tax credits such as the Earned Income Tax Credit (EITC) or education credits, which can directly reduce the amount of tax you owe.

Tip 4: Review and Adjust Your Withholding

Your withholding is the amount of money that your employer sets aside from your paycheck for federal income taxes. It’s essential to review your withholding to ensure you’re not overpaying or underpaying your taxes. You can adjust your withholding by submitting a new Form W-4 to your employer. Consider adjusting your withholding if: - You’ve had a change in income. - You’ve had a change in your family size (e.g., got married, had a child). - You’ve started or stopped claiming dependents.

Tip 5: Keep Accurate Records

Finally, keeping accurate records of your income, deductions, and taxes is vital for tax season and for understanding your financial situation throughout the year. Consider using: - Spreadsheet Software: Tools like Excel or Google Sheets can help you track your income and expenses. - Financial Management Apps: Apps like Mint or Personal Capital can help you monitor your finances and stay on top of your taxes. - Tax Preparation Software: Software like TurboTax or H&R Block can guide you through the tax filing process and help ensure you’re taking advantage of all the deductions and credits you’re eligible for.

📝 Note: It's always a good idea to consult with a financial advisor or tax professional to get personalized advice on managing your WA paycheck and maximizing your financial situation.

In the end, managing your WA paycheck effectively requires a combination of understanding your income, navigating the tax system, and making smart financial decisions. By following these tips and staying informed, you can better manage your finances and make the most of your hard-earned money.

What is the difference between gross income and net income?

+

Gross income is the total amount of money you earn before any deductions, while net income (or take-home pay) is the amount of money you take home after all deductions have been made.

Does Washington State have state income tax?

+

No, Washington State does not have a state income tax. However, residents are still subject to federal income tax and other deductions.

How can I maximize my take-home pay in Washington State?

+

You can maximize your take-home pay by contributing to a 401(k) or other retirement plans, utilizing health savings accounts, taking advantage of tax credits, and reviewing and adjusting your withholding as necessary.