New Jersey Tax Salary Calculator

Introduction to New Jersey Tax Salary Calculator

Calculating taxes can be a daunting task, especially when considering the various factors that influence tax rates. For individuals living in New Jersey, understanding the state’s tax laws and how they impact salary is crucial. The New Jersey tax salary calculator is a tool designed to simplify this process, providing individuals with an accurate estimate of their taxes based on their income. In this article, we will delve into the details of the New Jersey tax salary calculator, exploring its features, benefits, and how it can be used to navigate the complexities of tax calculation.

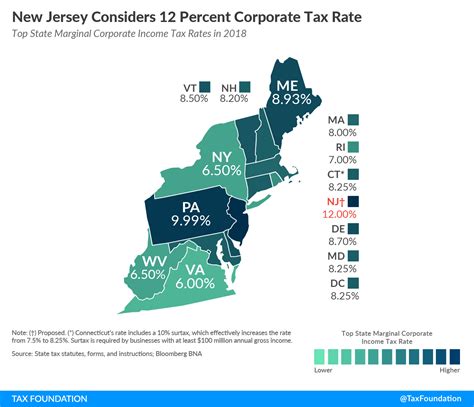

Understanding New Jersey Tax Laws

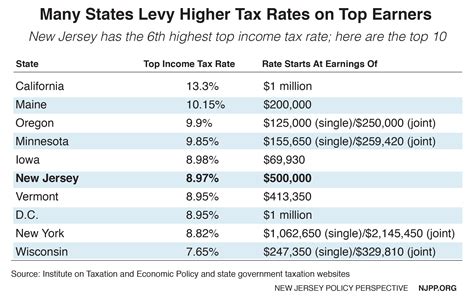

New Jersey has a progressive income tax system, with rates ranging from 5.525% to 10.75%. The tax rate applied to an individual’s income depends on their filing status and the amount of taxable income. For the 2022 tax year, the tax brackets are as follows:

| Filing Status | Taxable Income | Tax Rate |

|---|---|---|

| Single | 0 - 20,000 | 5.525% |

| Single | 20,001 - 35,000 | 6.370% |

| Single | 35,001 - 40,000 | 6.920% |

| Single | 40,001 - 75,000 | 7.970% |

| Single | 75,001 - 500,000 | 8.970% |

| Single | $500,001 and above | 10.750% |

These rates are subject to change, and it is essential to consult the New Jersey Division of Taxation for the most up-to-date information.

Features of the New Jersey Tax Salary Calculator

The New Jersey tax salary calculator is designed to provide individuals with a comprehensive understanding of their tax obligations. Some of the key features of this calculator include: * Income Input: Users can input their annual salary, allowing the calculator to determine their taxable income. * Filing Status: The calculator takes into account the user’s filing status, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). * Tax Deductions: Users can input their tax deductions, such as charitable donations, medical expenses, and mortgage interest. * Tax Credits: The calculator also accounts for tax credits, including the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits.

Benefits of Using the New Jersey Tax Salary Calculator

Using the New Jersey tax salary calculator can provide individuals with numerous benefits, including: * Accurate Tax Estimation: The calculator provides an accurate estimate of taxes owed, allowing individuals to plan their finances accordingly. * Simplified Tax Filing: By understanding their tax obligations, individuals can simplify the tax filing process, reducing the risk of errors and delays. * Informed Financial Decisions: The calculator enables individuals to make informed financial decisions, such as adjusting their withholding or exploring tax-saving strategies.

📝 Note: The New Jersey tax salary calculator is a tool designed to provide estimates and should not be considered as professional tax advice.

How to Use the New Jersey Tax Salary Calculator

Using the New Jersey tax salary calculator is a straightforward process. Simply follow these steps: * Visit the New Jersey Division of Taxation website or a reputable online tax calculator platform. * Input your annual salary and filing status. * Enter your tax deductions and credits. * Click the “Calculate” button to receive an estimate of your taxes owed.

Tax Planning Strategies for New Jersey Residents

In addition to using the New Jersey tax salary calculator, individuals can explore various tax planning strategies to minimize their tax liability. Some of these strategies include: * Maximizing Retirement Contributions: Contributing to a 401(k) or IRA can reduce taxable income, resulting in lower taxes owed. * Itemizing Deductions: Itemizing deductions, such as medical expenses and charitable donations, can help reduce taxable income. * Tax-Loss Harvesting: Selling securities that have declined in value can help offset capital gains, reducing taxes owed.

As we summarize the key points of the New Jersey tax salary calculator, it is essential to remember that tax laws and regulations are subject to change. Staying informed and consulting with a tax professional can help ensure that individuals are in compliance with all tax requirements.

What is the New Jersey tax salary calculator?

+

The New Jersey tax salary calculator is a tool designed to provide individuals with an accurate estimate of their taxes based on their income.

How do I use the New Jersey tax salary calculator?

+

To use the calculator, simply input your annual salary, filing status, tax deductions, and credits, and click the “Calculate” button to receive an estimate of your taxes owed.

What are some tax planning strategies for New Jersey residents?

+

Some tax planning strategies for New Jersey residents include maximizing retirement contributions, itemizing deductions, and tax-loss harvesting.