5 Ohio Tax Calculators

Introduction to Ohio Tax Calculators

Ohio, like many other states, has its own set of tax laws and regulations that can make calculating taxes somewhat complex for its residents. To simplify this process, various Ohio tax calculators have been developed. These calculators can help individuals and businesses estimate their tax liabilities, plan their finances more effectively, and ensure compliance with state tax laws. In this article, we will explore five Ohio tax calculators, their features, and how they can be beneficial for taxpayers.

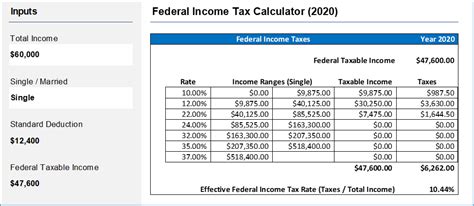

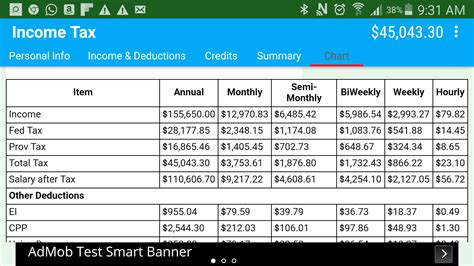

1. Ohio Income Tax Calculator

The Ohio income tax calculator is a tool designed to help residents calculate their state income tax. Key features of this calculator include the ability to input income from various sources, such as wages, salaries, and investments, and to deduct allowable expenses and exemptions. By using this calculator, individuals can get an accurate estimate of their income tax liability and plan their tax payments accordingly.

2. Ohio Sales Tax Calculator

For businesses and individuals dealing with sales transactions, the Ohio sales tax calculator is an invaluable tool. This calculator helps in determining the sales tax rate applicable to different transactions, considering the various rates that apply across different counties and municipalities within Ohio. By accurately calculating sales tax, businesses can avoid under or overcharging their customers, which can lead to compliance issues or financial losses.

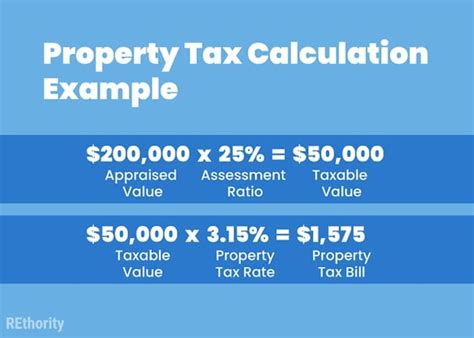

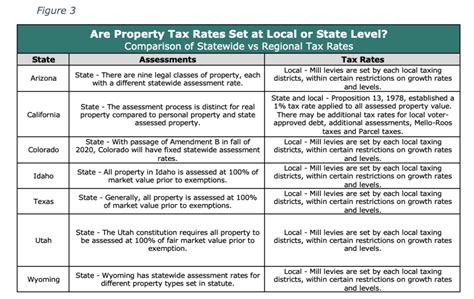

3. Ohio Property Tax Calculator

Property owners in Ohio can benefit from using a property tax calculator to estimate their annual property tax bills. This tool considers factors such as the assessed value of the property, the tax rate of the local jurisdiction, and any applicable exemptions or reductions. Understanding property tax liabilities in advance can help homeowners and businesses budget more effectively for these expenses.

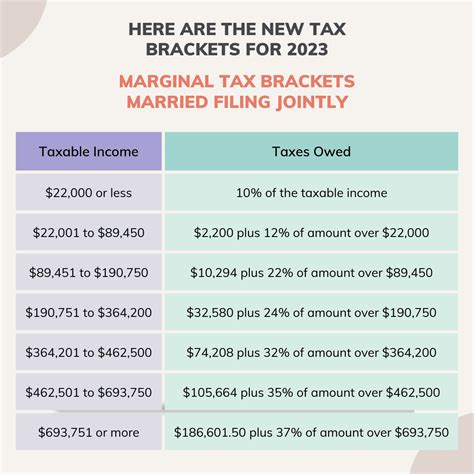

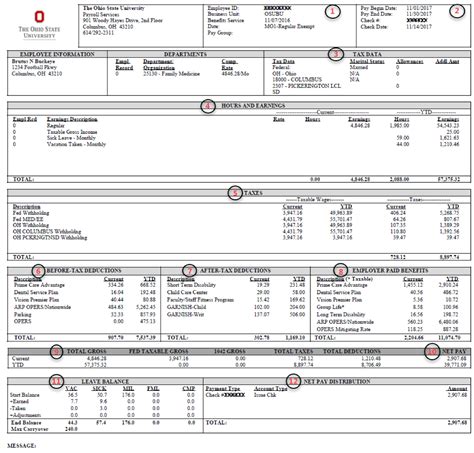

4. Ohio Withholding Tax Calculator

Employers in Ohio use the withholding tax calculator to determine how much state income tax to withhold from their employees’ wages. This calculator takes into account the employee’s income level, filing status, and the number of exemptions claimed. Accurate withholding is crucial for both employers, to avoid penalties for underwithholding, and employees, to ensure they do not face a large tax bill when filing their tax returns.

5. Ohio Tax Refund Calculator

After filing their tax returns, many taxpayers look forward to receiving a refund if they have overpaid their taxes throughout the year. The Ohio tax refund calculator helps individuals estimate the amount of their refund based on their tax payments, income, and eligible deductions. This tool can provide taxpayers with a clearer picture of what to expect and help them plan how to use their refund wisely.

📝 Note: It's essential to regularly update tax calculators to reflect any changes in tax laws or rates to ensure accuracy and compliance.

In summary, Ohio tax calculators are designed to make tax planning and compliance easier for residents and businesses. By utilizing these tools, individuals can better understand their tax obligations, avoid potential penalties, and make informed financial decisions. Whether it’s for income tax, sales tax, property tax, withholding tax, or estimating a tax refund, there’s a calculator available to simplify the process and provide peace of mind.

What is the primary purpose of using Ohio tax calculators?

+

The primary purpose of using Ohio tax calculators is to accurately estimate tax liabilities and plan finances effectively, ensuring compliance with Ohio’s tax laws and regulations.

How often should I update my tax calculations?

+

It’s advisable to update your tax calculations whenever there’s a change in your income, deductions, or exemptions, and at least annually to reflect any updates in tax laws or rates.

Can Ohio tax calculators be used for both personal and business tax purposes?

+

Yes, there are Ohio tax calculators designed for personal use, such as income tax and property tax calculators, and others tailored for business needs, like sales tax and withholding tax calculators.