5 Ways Stop War Taxes

Introduction to War Taxes

War taxes have been a contentious issue for many years, with some people believing that paying taxes is a civic duty, while others see it as a way to condone and fund wars. The debate surrounding war taxes has sparked a movement of people who are seeking ways to avoid paying taxes that may be used to fund military actions. In this blog post, we will explore five ways to stop war taxes and provide information on the implications and consequences of such actions.

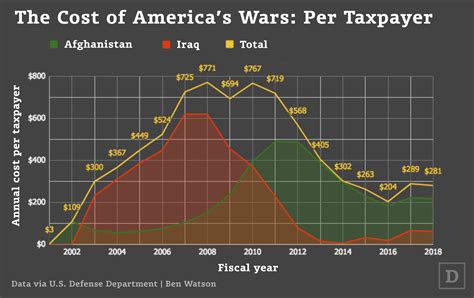

Understanding War Taxes

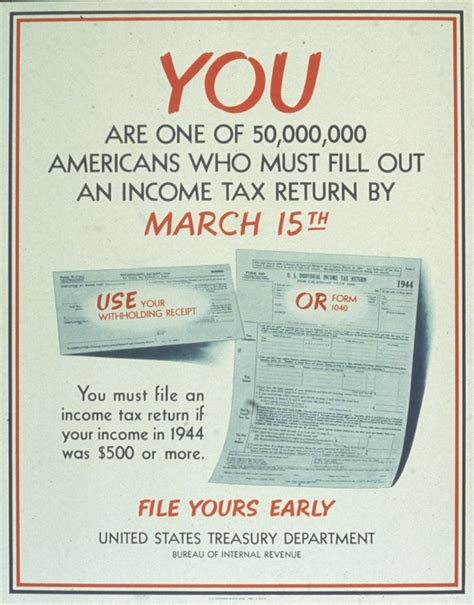

Before we dive into the ways to stop war taxes, it is essential to understand what war taxes are and how they work. War taxes are a type of tax that is levied by governments to fund military actions and wars. These taxes can be in the form of income tax, sales tax, or other types of taxes. The revenue generated from war taxes is used to fund military personnel, equipment, and operations.

5 Ways to Stop War Taxes

There are several ways to stop war taxes, and we will explore five of them below: * Conscientious Objection: One way to stop war taxes is to become a conscientious objector. Conscientious objectors are individuals who refuse to pay taxes due to moral or ethical reasons. In the United States, for example, individuals can apply for a conscientious objector status, which allows them to redirect their taxes to peaceful purposes. * Tax Resistance: Another way to stop war taxes is through tax resistance. Tax resistance involves refusing to pay taxes or a portion of taxes that may be used to fund military actions. This can be done through various methods, such as reducing income, deducting charitable donations, or using tax credits. * Divestment: Divestment is a strategy that involves removing investments from companies or institutions that are involved in the production of military equipment or supplies. By divesting from these companies, individuals can help to reduce the funding available for military actions. * Alternative Currency: Using alternative currencies, such as cryptocurrencies or local currencies, can help to reduce the reliance on traditional currencies that may be used to fund wars. Alternative currencies can also provide a way to avoid paying taxes that may be used to fund military actions. * Advocacy and Activism: Finally, advocacy and activism can be an effective way to stop war taxes. By raising awareness about the issue and advocating for policy changes, individuals can help to bring about a shift in the way that taxes are used.

Implications and Consequences

While stopping war taxes may seem like a noble cause, there are implications and consequences to consider. For example, refusing to pay taxes can result in penalties, fines, and even imprisonment. Additionally, reducing income or divesting from companies can have financial implications for individuals and communities.

🚨 Note: It is essential to understand the laws and regulations surrounding tax resistance and conscientious objection in your country or region before taking any action.

Benefits of Stopping War Taxes

Despite the implications and consequences, there are benefits to stopping war taxes. For example, by redirecting taxes to peaceful purposes, individuals can help to fund initiatives that promote peace, justice, and human rights. Additionally, stopping war taxes can help to raise awareness about the issue and bring about a shift in the way that taxes are used.

| Method | Benefits | Implications |

|---|---|---|

| Conscientious Objection | Redirecting taxes to peaceful purposes, raising awareness | Penalties, fines, and imprisonment |

| Tax Resistance | Reducing funding for military actions, promoting peace and justice | Financial implications, penalties, and fines |

| Divestment | Reducing funding for military equipment and supplies, promoting peace and justice | Financial implications, potential loss of income |

| Alternative Currency | Reducing reliance on traditional currencies, promoting peace and justice | Financial implications, potential loss of income |

| Advocacy and Activism | Raising awareness, promoting policy changes, and promoting peace and justice | Time-consuming, potentially costly |

In summary, stopping war taxes is a complex issue that requires careful consideration of the implications and consequences. However, by understanding the different methods available and the benefits and implications of each, individuals can make informed decisions about how to stop war taxes and promote peace and justice.

As we reflect on the information provided, it becomes clear that stopping war taxes is not just about avoiding taxes, but about promoting a culture of peace and justice. By working together and using the methods outlined above, we can create a more just and peaceful world.

What is a conscientious objector?

+

A conscientious objector is an individual who refuses to pay taxes due to moral or ethical reasons.

What are the implications of tax resistance?

+

The implications of tax resistance include penalties, fines, and potential imprisonment.

How can I get involved in advocacy and activism to stop war taxes?

+

You can get involved in advocacy and activism to stop war taxes by joining organizations, attending events, and using social media to raise awareness about the issue.